2019 Wrap-up for Transformative Technologies

With New Year’s past us it means we’ve entered not only a new year but new decade as well! So it’s the high time for a Transformative Technology mental health funding update 2019 wrap-up. From high dollar investments and partnerships to mergers and acquisitions a lot is happening in the world of healthcare technology. The question is, what’s happening specifically in the world of mental health technology?

Investments:

As we dive into investments there are too many to mention all at once, so here are a few from MedicalStartups.org top 35 mental health startups of 2019. Wearables, VR, Biopharma, Platforms, AI, Apps, Transcranial Stimulation and more OOOH MYYY!

Funding: $176.3 m

Neuronetics has pioneered and refined the NeuroStar TMS Therapy system. This non-invasive, non-systemic treatment for depression uses a highly focused, pulsed magnetic field to stimulate function in targeted brain regions.

Funding: $116M

Calm is working to bring the amazing benefits of meditation to a busy world. Calm operates an online portal which allows busy and information loaded web workers to reduce stress.

Funding: $54M

BlackThorn Therapeutics is a clinical-stage biopharmaceutical company that uses a novel and robust platform (INFORM™) to link behavioral deficits with brain physiology to discover and develop targeted treatments for neurobehavioral disorders.

Funding: $14.7M

BrainCheck is a mobile interactive test for cognitive health.

Funding: $8M

Spring uses AI to help patients with mental health problems feel better faster.

Funding: $6.6M

BioBeats builds stress app that respond to physiologic data and learns from how a person interacts with others, to help people live more engaging, healthier lives.

Funding: $6.3M

Sentio is a behavioral health startup offering an emotion-sensing wearable that that provides continuous monitoring and real-time personalized interventions for individuals who suffer from anxiety and depression.

Partnerships:

Next up is mental health partnerships, but what is a partnership per se? A partnership is a network that includes hospitals, physicians, providers and other delivery system partners. Enabling organizations to provide the full continuum of services in its community or geographic area. At this point in time, we are seeing many of the bigger dogs coming to the partnership table the rest of the pack will surely be bounding along shortly. Here are just a few to highlight:

Quartet, an innovative health care technology and services company, announced a strategic partnership with Centene Corporation to ensure the most vulnerable populations have access to mental health care.

Valera Health and Capital District Physicians’ Health Plan, Inc. (CDPHP) are pleased to announce a multi-year alliance that will expand member access to high-quality mental health and substance use case management services.

NeuroFlow announced a new partnership with Jefferson Health, one of the largest health systems in Philadelphia. Their software enables behavioral health specialists and psychologists to remotely monitor a patient’s mental wellness.

Merger and Acquisitions (M&A):

Like the Cookie Monster gobbling down cookies, there has been a lot of movement across the digital health space in Mergers and Acquisitions, most notably Google’s acquisition of Fitbit in the billions.

In terms specifically of mental health tech here is what’s been happening across this M&A landscape. According to Irving Levin Associates, behavioral health care M&A (into which mental health falls) dropped in the third quarter down 35% with only 17 publicly announced transactions. Private equity firms cleaned up in the space as purchasers accounting for 76% of all behavioral health sector deals.

According to Hammond Hanlon and Camp (H2C) Industry Insights, they state that there were 21 behavioral health transactions in the third quarter of 2019, remained very active and showed a 137% increase from the same 9 months in 2018.

Shuttered Doors:

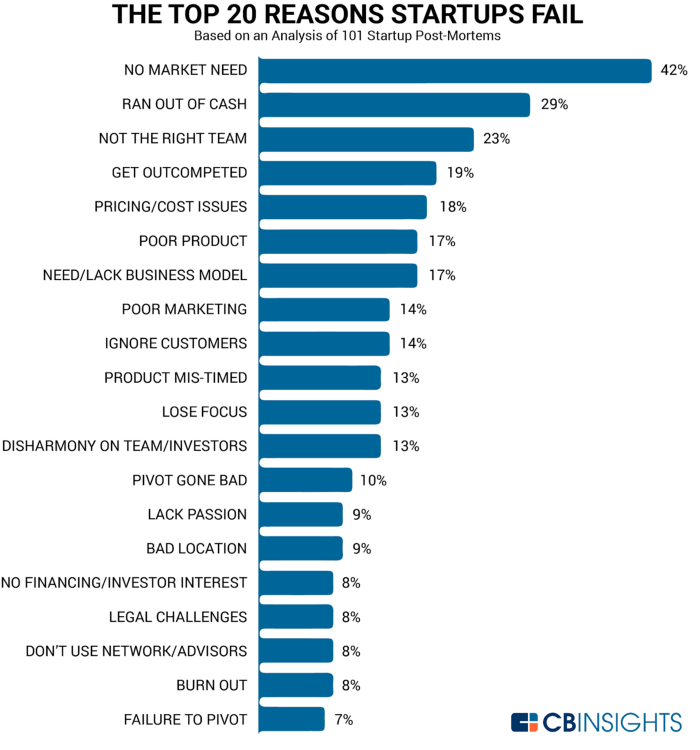

It seems that there are a thousand and one ways for tech start-ups to end up pushing up daisies and shuttering their doors. This year thus far in the entire tech startup industry 480 plus companies have in one way or another closed down. It doesn’t seem to vary too much from tech sector to tech sector which is why we often hear about tech’s 90% mortality rate. The following infographic from CBINSIGHTS does a great job of breaking it all down.

Here are a couple of our brothers-and sisters-in-arms in the mental health technology sector who are no longer active according to CBINSIGHTS.

Sophia

The company, which sought to match people with life counselors, now redirects users to other platforms seeking mental wellness resources:

Arivale

A company in the aging whole-body wellness space whose vision was to transform personal health.

A Resurrection:

Every once in a while a heartbeat emerges postmortem and we are happy to say that according to MedCityNews Lantern rises to live on as part of Spring Health delivering CBT based therapies for chronic disease management.

Physical healthcare and behavioral healthcare funding in contrast always tends to be a bit lopsided. We need to all be aware and mindful that wellness is all encompassing, and we cannot have true physical health without also concentrating on mental health as well

As always, in closing, we all must remember that mental health is never a 1 size fits all approach. Although the diagnosis name may be the same, how it presents can be vastly different in each case. We need to better understand each case and groupings. In order to do so, we need to paint a daily picture and for that we need data and transformative technologies.

AND

Remember that it is also a double-edged sword. With any health data comes a responsibility of profound ethical proportions. We should all be good stewards and know that this data is not a dollar sign above a person’s head, but a way to bring about better wellness and heightened consciousness across the globe.